Solana’s Breakpoint 2025 conference in Abu Dhabi from December 11-13, 2025, marked a clear turning point for the network. What was once viewed primarily as a high-speed

Layer-1 for DeFi and

meme trading is now positioning itself as a full-stack consumer blockchain, one designed to support

payments,

AI-driven applications,

tokenized assets, and real-world financial infrastructure at global scale.

Across three days of announcements, Solana’s ecosystem revealed a roadmap centered on real adoption rather than experimentation. From institutional tokenization and onchain finance to mobile-native consumer apps and AI-native tooling, Breakpoint 2025 signaled a decisive shift:

Solana is no longer building for crypto-native users alone but is preparing for mainstream usage.

This article explores what changed at Solana Breakpoint 2025 conference, why 2026 could be Solana’s breakout year, and how the network’s evolving architecture positions it for mass-market adoption.

Key Takeaways at a Glance

1. Solana has moved beyond experimentation into production-scale usage. The network now processes billions of transactions per month, supports over $8.1 billion in DeFi TVL, and underpins growing volumes of stablecoin payments, tokenized assets, and consumer-facing applications.

2. Institutional adoption is no longer theoretical. Asset managers, payment firms, and onchain funds are actively deploying capital on Solana, driven by rising demand for tokenized treasuries, onchain yield, and real-time settlement.

3. Forecasts from firms such as Bitwise suggest that institutional demand could exceed new

SOL issuance by 20–50% in 2026, with projected inflows of $3.5–$4.5 billion compared to an estimated 23 million SOL or around $3.2 billion in new annual supply. If realized, this imbalance would create sustained structural demand pressure on the asset.

4. The application layer is maturing rapidly. Wallets, prediction markets, and onchain financial products are reaching mainstream scale, with millions of active users and billions in monthly volume. This signals a shift from speculative usage toward durable, utility-driven activity.

5. 2026 represents an inflection point rather than a hype cycle. With regulatory clarity gradually improving, stablecoin adoption accelerating, and macro conditions potentially easing, Solana is positioned to transition from a high-performance blockchain into a core financial and application layer for global users.

What Is Solana Layer-1 Network and Why Is It Important in 2026?

Solana is a high-performance blockchain designed to support large-scale consumer and financial applications with fast speeds and low transaction costs. Built for scalability, it processes thousands of transactions per second and now supports over 50 million monthly active addresses, making it one of the most widely used blockchain networks globally.

Key Solana Metrics From 2025: Over 3.5B Daily Transactions, $8B+ TVL

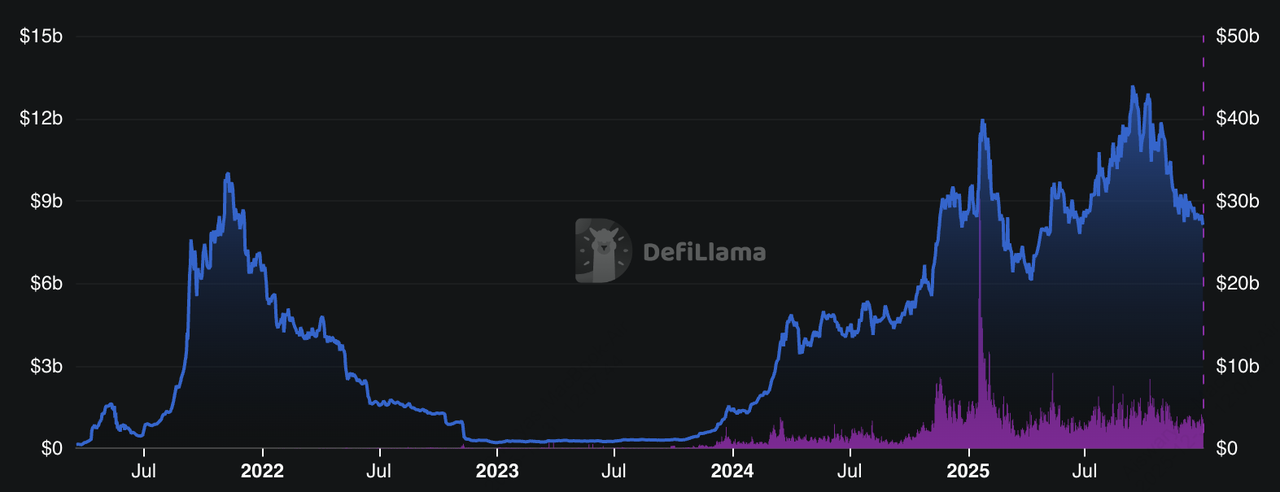

Solana DeFi TVL | Source: DefiLlama

As of 2025, Solana has evolved beyond a DeFi-focused chain into a full-stack ecosystem for payments, trading, tokenized assets, and consumer apps. Solana remains one of the most actively used blockchains in the market, with SOL trading with a market cap of roughly $70.6 billion, supported by strong onchain fundamentals. The network processes over 3.5 billion transactions daily, serves more than 50 million monthly active users, and records approximately $3.8 billion in daily

DEX volume, alongside $4 million in daily app revenue and more than $3.4 billion in daily app-generated revenue.

Solana’s DeFi ecosystem holds about $8.1 billion in total value locked (TVL), while its fully diluted valuation stands near $77.4 billion. The network previously reached an all-time high of $293.31 in January 2025, and although SOL now trades roughly 57% below that peak, its scale, user activity, and expanding role in payments, tokenization, and consumer apps continue to position it as one of the most active and economically significant blockchains in the market today.

Solana Ecosystem Growth and Key Use Cases: $3-4B DEX Volume, $14B+ in Stablecoins

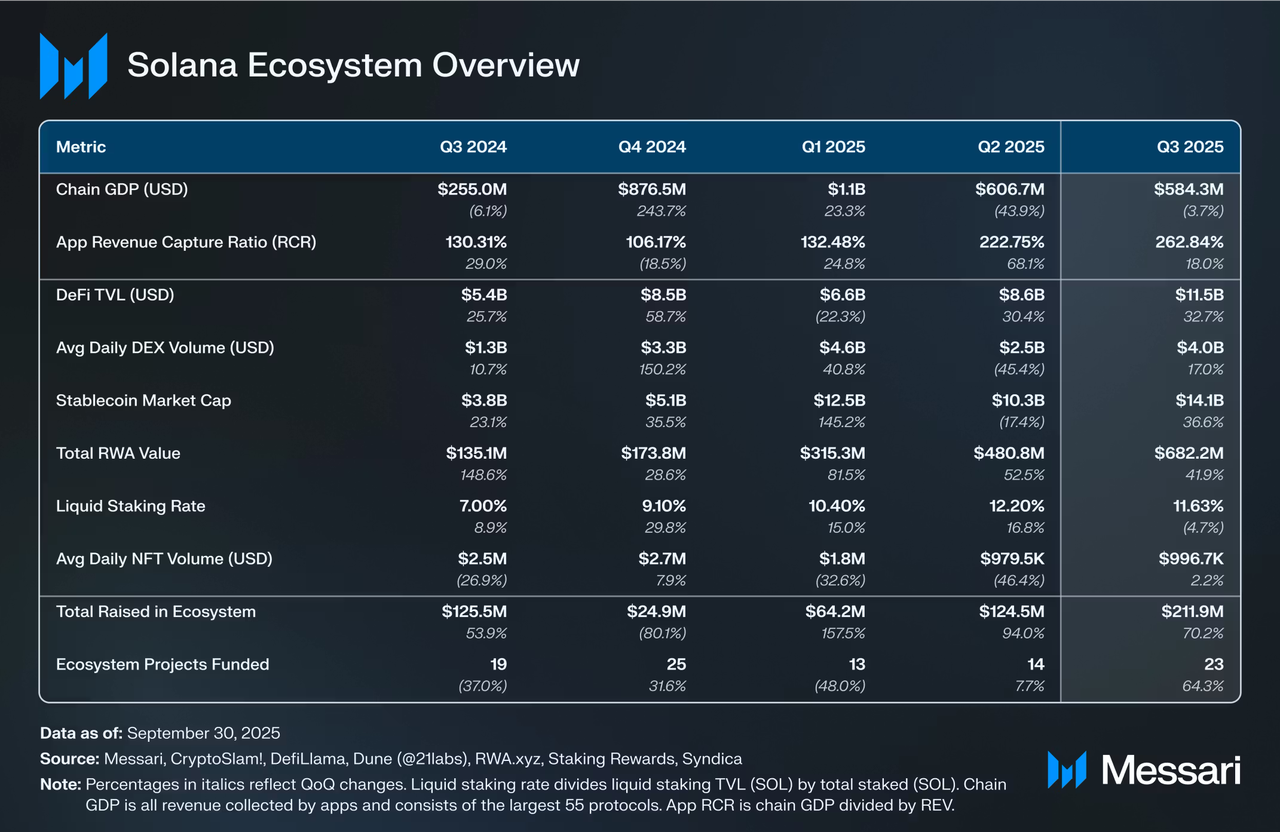

An overview of the Solana ecosystem as of Q3 2025 | Source: Messari

Solana’s ecosystem now spans several high-growth verticals:

1. DeFi and Trading: Solana consistently processes $3–4 billion in daily DEX volume, ranking among the top blockchains globally. High-performance protocols such as

Jupiter,

Orca, and

Raydium account for a large share of onchain trading activity, while perpetuals and structured products continue to expand. Daily transaction counts regularly exceed 50–60 million, underscoring Solana’s role as a high-throughput financial layer.

2. Payments and Stablecoins: Stablecoin activity on Solana has reached meaningful scale, with total stablecoin market capitalization on the network exceeding $14.6 billion.

USDC remains the dominant asset, accounting for over 68% of circulating stablecoin supply, valued around $9.9 billion, followed by

USDT at $2.15 billion and

PayPal’s PYUSD at approximately $870 million. In addition, Visa and PayPal integrations have validated Solana’s suitability for real-time settlement, with transaction costs typically measured in fractions of a cent.

3. Tokenized Assets and RWAs: More than $10 billion in

tokenized real-world assets, including U.S. Treasuries, funds, and yield-bearing instruments, are now being built or issued on Solana. Asset managers such as Franklin Templeton and infrastructure providers like R3 have selected Solana for onchain fund issuance, citing its throughput, cost efficiency, and programmability.

4. Consumer Applications and NFTs: Solana remains one of the most active consumer blockchain ecosystems, supporting tens of millions of monthly users across

gaming,

NFTs, and

social applications. According to DappRadar, Solana-based apps collectively process over 4–5 million daily active wallets, with gaming alone accounting for roughly 25% of all onchain activity in Q3 2025. NFT usage remains substantial, with 18.1 million NFT transactions recorded in Q3 and over $1.6 billion in trading volume, driven by platforms like Sorare,

Gods Unchained, and emerging tokenized asset marketplaces. Low transaction fees, often fractions of a cent, enable high-frequency interactions such as in-game actions, NFT minting, and microtransactions, reinforcing Solana’s role as the leading chain for consumer-scale onchain activity.

Why Solana’s 2025 Momentum Matters: $3.3T+ Annualized Trading Volume

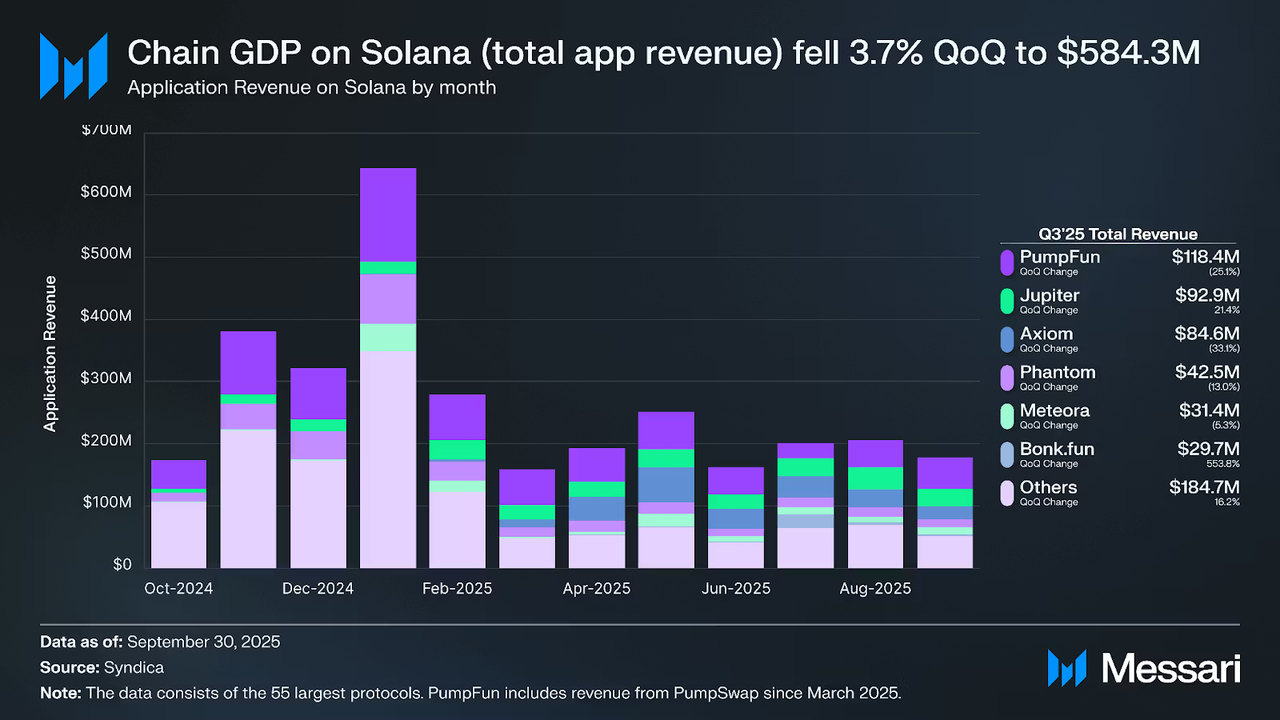

Solana's total app review as of Q3 2025 | Source: Messari

With $3.3 trillion in annualized trading volume, expanding institutional participation, and accelerating onchain activity, Solana is no longer just a high-speed blockchain but is becoming a core financial and consumer infrastructure layer. The combination of scale, low costs, and real-world adoption positions Solana as one of the strongest candidates to lead the next phase of mainstream crypto adoption in 2026.

Was Breakpoint 2025 a Turning Point for Solana?

Solana Breakpoint 2025 marked a clear inflection point in the network’s evolution, from a high-performance blockchain to a full-scale financial and consumer application platform. Held in Abu Dhabi from December 11 to 13, 2025, Solana Breakpoint brought together more than 7,000 attendees from over 100 countries, marking a pivotal moment as the network showcased its transition from experimentation to large-scale, real-world deployment.

Key themes emerged across the three-day event:

• Tokenization of real-world assets (RWAs)

• Consumer-grade crypto applications

• Institutional-grade infrastructure and compliance

• AI-integrated financial tools

• Mobile-first blockchain distribution

Unlike earlier conferences focused on throughput and developer tooling, this year’s agenda centered on production-ready applications, institutional adoption, and mass-market usability.

1. Institutional Capital Moves Onchain: Tokenized Funds, RWAs Cross $10B

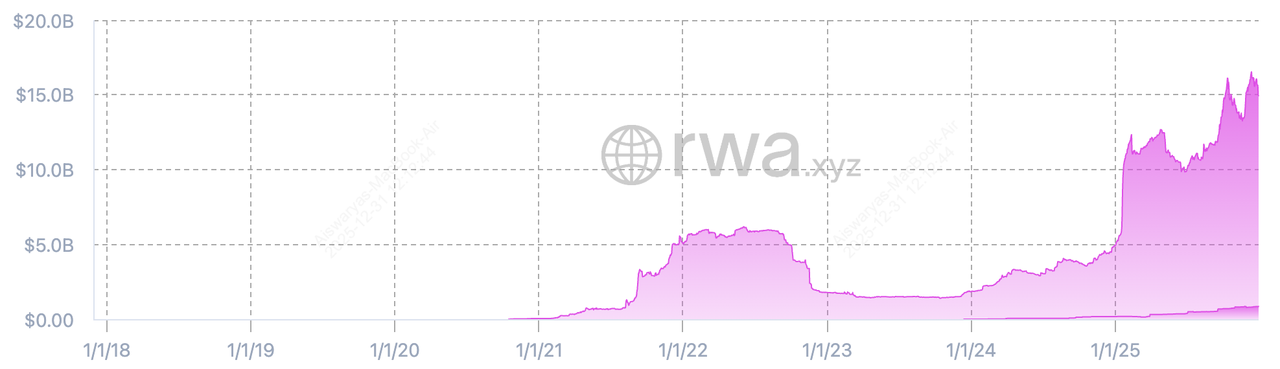

Tokenized RWAs, including stablecoins, on Solana | Source: RWA.xyz

One of the clearest signals from Breakpoint 2025 was the acceleration of institutional capital flowing onto Solana. Multiple announcements confirmed that real-world assets (RWAs), including tokenized treasuries, credit products, and onchain funds, are now being deployed at production scale rather than in pilot programs.

Key developments included:

• Tokenized funds and RWAs now exceeding $10 billion in onchain value across Solana-based platforms, with asset managers using the network for settlement, issuance, and secondary trading. Of these,

tokenized stocks on Solana account for over $181 million as of December 2025.

• Institutional custodians and asset managers adopting Solana for onchain accounting and compliance workflows, attracted by near-instant settlement and low transaction costs.

• Onchain settlement volumes reaching billions of dollars per day, driven by stablecoins and tokenized assets used for treasury management, payments, and liquidity operations.

This shift reflects a broader industry trend: institutions are moving toward blockchains that combine high throughput, low latency, and predictable costs, areas where Solana has established a structural advantage over slower, multi-layer architectures.

2. The Rise of Consumer-Grade Crypto Apps

Breakpoint 2025 also highlighted how Solana is transitioning from developer-first infrastructure to mass-market financial applications.

Modern Solana wallets now function as full financial platforms, offering:

• Integrated swaps and DEX aggregation

• Tokenized prediction markets and event-based trading

• AI-assisted portfolio tools and automated strategies

This shift has coincided with rapid user growth. Solana now supports over 50 million monthly active addresses, processes 3.5 billion transactions per month, and generates approximately $4 million in daily application revenue, figures that rival or exceed many traditional fintech platforms.

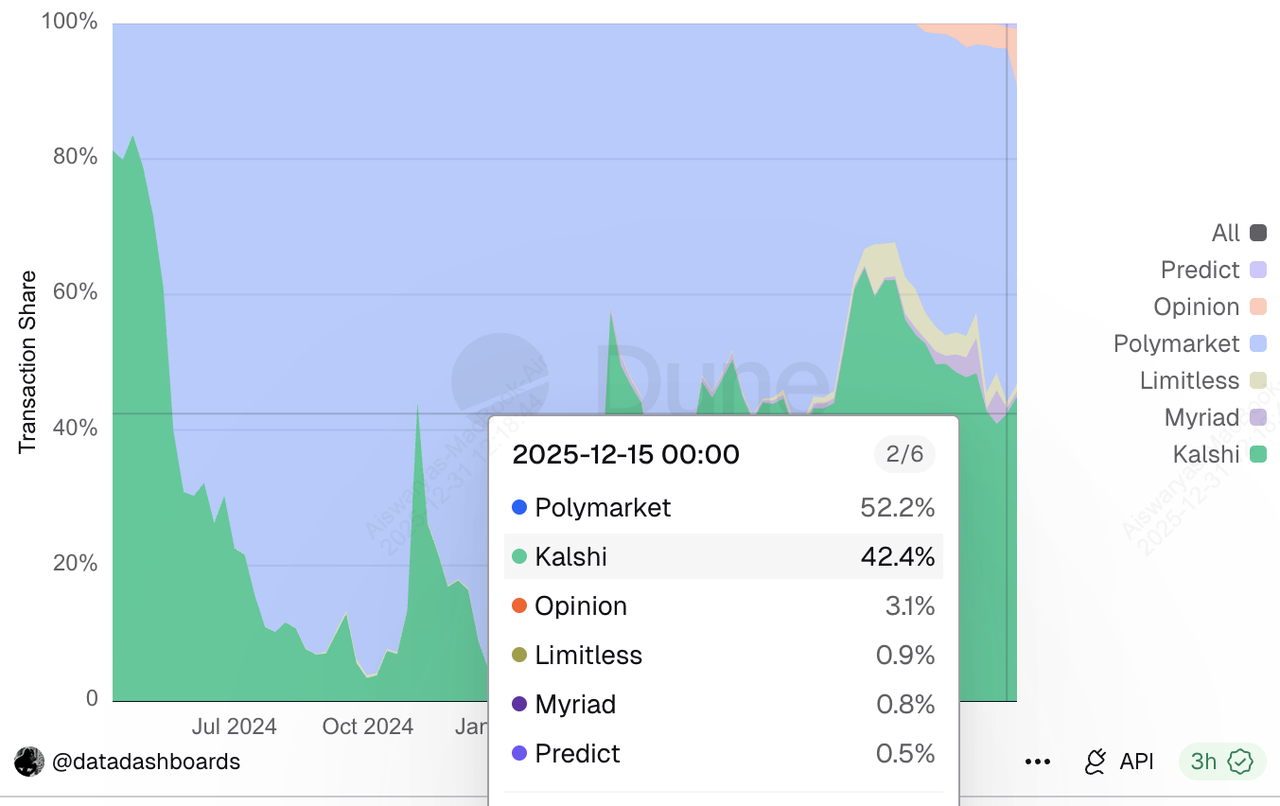

3. Prediction Markets Are Becoming a Core Onchain Use Case, Exceeding $1B Volume

Kalshi weekly transactions | Source: Dune Analytics

Prediction markets have emerged as one of the fastest-growing onchain sectors, and Solana is quickly becoming their primary execution layer. By late 2025, onchain prediction platforms were processing hundreds of millions of dollars in monthly volume, with combined activity across major venues exceeding $1 billion during peak periods. This surge has been driven by ultra-low fees, instant settlement, and native wallet integrations that remove friction for mainstream users.

A major inflection point came when

Phantom integrated

Kalshi’s regulated prediction markets, instantly exposing more than 20 million wallet users to onchain event trading. Users can now trade real-world outcomes, from elections to economic data, directly from their wallet using SOL, USDC, or other Solana-based assets. This move followed similar integrations across the ecosystem, including Solflare and other

Solana-native wallets, accelerating user adoption at scale.

The growth is measurable. In November 2025,

Kalshi and Polymarket together processed nearly $10 billion dollars in cumulative trading volume, with Kalshi alone recording over $5.8 billion in monthly volume at peak activity. Many of these markets are now being tokenized directly on Solana, enabling composability with DeFi protocols, automated market-making, and onchain liquidity aggregation.

4. AI-Native Finance Is Moving Onchain

AI-driven financial systems are rapidly becoming a core onchain use case on Solana. At Breakpoint 2025, multiple teams demonstrated autonomous agents executing trades, managing liquidity, and optimizing portfolios in real time, enabled by Solana’s sub-second finality and low transaction costs. Today, AI-powered trading and automation tools on Solana collectively process millions of onchain transactions per day, with some platforms executing tens of millions of dollars in automated volume across DEXs and prediction markets.

This shift is accelerating as AI systems integrate directly with wallets and protocols. Tools like Solflare’s AI assistant, onchain trading agents, and autonomous market-makers now operate continuously, responding to price movements and liquidity conditions without human input. With Solana capable of sustaining thousands of transactions per second and processing over 200 billion total transactions to date, the network is increasingly becoming the execution layer for machine-driven finance, where software, not humans, becomes the primary economic actor.

5. Onchain Identity and Reputation Systems Take Shape

Another major theme at Breakpoint 2025 was the rapid maturation of onchain identity and reputation infrastructure designed to support compliant, large-scale financial activity. Multiple projects showcased systems that replace traditional KYC databases with cryptographic credentials, wallet-based attestations, and onchain reputation scores. These frameworks are already being used across lending, tokenized asset issuance, and regulated trading platforms, where user eligibility, jurisdiction checks, and risk scoring are required without exposing personal data.

Data shared at the event showed that millions of wallets now interact with identity-linked protocols, with some identity layers processing tens of millions of verifications per month. Several Solana-based platforms reported onboarding institutional users and regulated entities using onchain attestations instead of centralized KYC databases. This shift allows applications to remain compliant while preserving user privacy and composability, a critical step toward scaling DeFi, RWAs, and compliant financial products to a global user base.

Solana’s Technical Edge: Built for Scale, Not Experiments

A major reason Solana continues to attract both developers and institutions is its performance-first architecture, designed to operate at internet scale rather than optimize for theoretical throughput. In 2025, this advantage became tangible as the network consistently processed thousands of transactions per second in production, with sub-second finality and average transaction fees well below $0.01, even during periods of peak demand.

Firedancer Upgrade Lets Solana Validators Process Over 1M TPS

The rollout of

Firedancer, a new validator client developed by Jump Crypto, represents a major leap forward. In test environments, Firedancer has demonstrated the ability to process over 1 million transactions per second, while live deployments are already improving network stability and fault tolerance. Importantly, Firedancer introduces client diversity, reducing systemic risk and increasing decentralization across the validator set, a critical requirement for institutional-grade infrastructure.

Data Availability and Execution Efficiency

Unlike rollup-based ecosystems that fragment liquidity across multiple execution layers, Solana operates as a single, unified execution environment. This architecture eliminates cross-rollup latency, simplifies developer tooling, and allows applications to interact in real time without bridges or asynchronous settlement. For consumer finance, trading, and AI-driven applications that depend on speed and reliability, this design has become a decisive advantage, enabling Solana to support high-throughput workloads that other chains struggle to handle efficiently.

What to Expect From Solana (SOL) in 2026

Solana’s investment narrative is shifting from speculative performance to structural adoption. As highlighted throughout Breakpoint 2025, the network is no longer defined primarily by throughput metrics, but by its growing role as infrastructure for payments, tokenized assets, and consumer financial applications. This transition is beginning to show up in both onchain data and institutional forecasts.

Structural Demand Drivers: 65% SOL in Staking, RWAs, Developer Activity

Several long-term demand forces are converging around SOL:

• Staking and network security: Over 65% of circulating SOL is currently staked, reducing liquid supply while reinforcing network security. As institutional staking products expand, demand for SOL as a yield-bearing asset continues to grow.

• Tokenized assets and RWAs: With more than $10 billion in tokenized assets already live or in deployment pipelines on Solana, usage of SOL for fees, settlement, and collateral is rising in parallel.

• Developer and application growth: Solana now supports over 50 million monthly active addresses and processes billions of transactions per month, reinforcing its position as one of the most actively used blockchains globally.

Together, these trends are shifting SOL’s demand profile from speculative trading toward structural utility.

Institutional Outlook: Solana Is Positioned for the Next Capital Wave

Data from major research firms and market observers increasingly points to Solana as one of the primary beneficiaries of the next phase of institutional crypto adoption. The shift is being driven not by speculative trading alone, but by structural changes in how capital, payments, and financial infrastructure are moving onchain.

1. Institutional Capital Is Outpacing 2.3M New SOL Token Supply

According to projections cited by Bitwise, institutional demand for crypto assets is set to exceed new token issuance across major networks, including Solana. In 2026 alone, estimated issuance for SOL is approximately 23 million tokens valued at around $3.2 billion, while

Solana ETF and institutional inflows are projected to exceed that amount. Similar dynamics are already visible in

Bitcoin and

Ethereum, where ETF demand has consistently outpaced new supply. This imbalance creates structural supply pressure, an environment where long-term demand outstrips issuance rather than relying on speculative inflows.

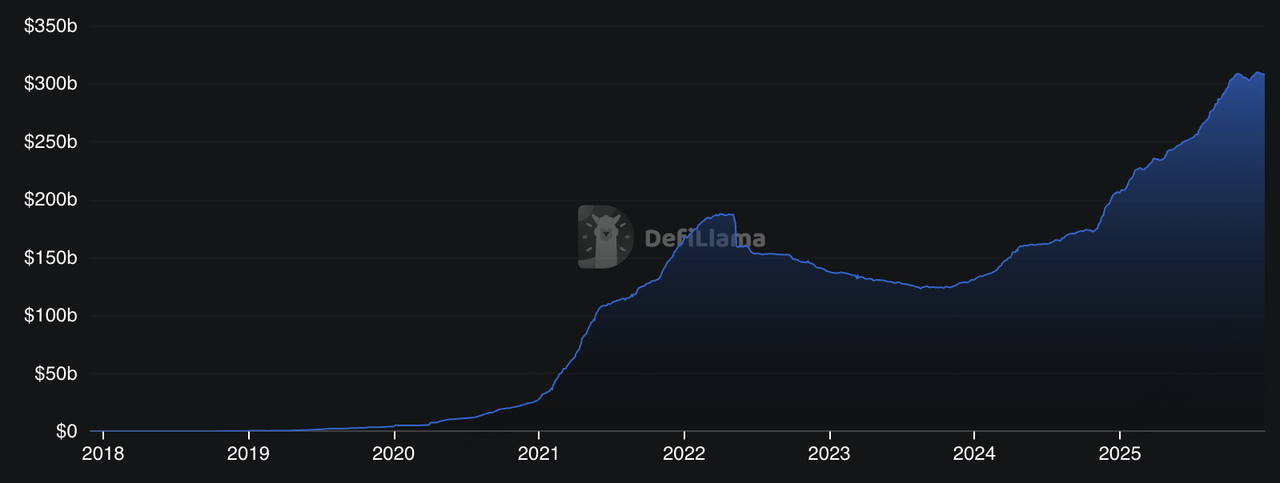

2. Stablecoins Are Becoming a Macroeconomic Force, Expected to Touch $500B in 2026

Total market cap of stablecoins | Source: DefiLlama

Stablecoins now represent one of the fastest-growing segments of crypto infrastructure. According to industry data, total stablecoin supply has grown from $205 billion to over $307 billion, with projections pointing toward $500 billion by 2026.

Much of this growth is occurring in emerging markets, where users rely on stablecoins as a hedge against inflation and currency controls. In some regions, local currencies have lost over 80% of their value, accelerating adoption of USD-denominated onchain alternatives.

Solana plays a central role in this trend:

• It supports high-throughput stablecoin settlement at near-zero cost

• It processes a growing share of global USDC and

PYUSD transaction volume

• It is increasingly used for payroll, remittances, and onchain treasury operations

This has led regulators and central banks to acknowledge that stablecoins are moving beyond being experimental to becoming part of global payment infrastructure.

3. Onchain Vaults and Tokenized Finance Are Scaling Rapidly to $9B in 2025

Another major inflection point is the rise of onchain vaults, often described as “ETFs on-chain.” These structures allow users to deposit stablecoins or crypto assets into professionally managed strategies governed by smart contracts. Onchain vault AUM grew from under $100 million in early 2024 to nearly $9 billion by late 2025. Platforms such as

Morpho,

Euler, and emerging institutional vaults account for the majority of this growth.

Analysts expect vault AUM to double again in 2026, driven by institutional participation and improved risk controls. These vaults represent a shift from speculative DeFi toward structured, risk-managed yield, a prerequisite for pension funds, asset managers, and large allocators.

A Shift From Speculation to Utility

Unlike previous market cycles driven largely by retail speculation, Solana’s current growth is increasingly anchored in real usage: transaction fees, onchain revenue, and enterprise-grade deployments. With daily DEX volumes exceeding $3.8 billion, over $8.1 billion in DeFi TVL, and expanding institutional participation, SOL is evolving into a core settlement asset rather than a purely speculative token.

If these trends persist, 2026 could mark the point where Solana transitions from a high-performance blockchain into a foundational layer for global finance, one where value accrues not from hype, but from sustained economic activity running directly on-chain.

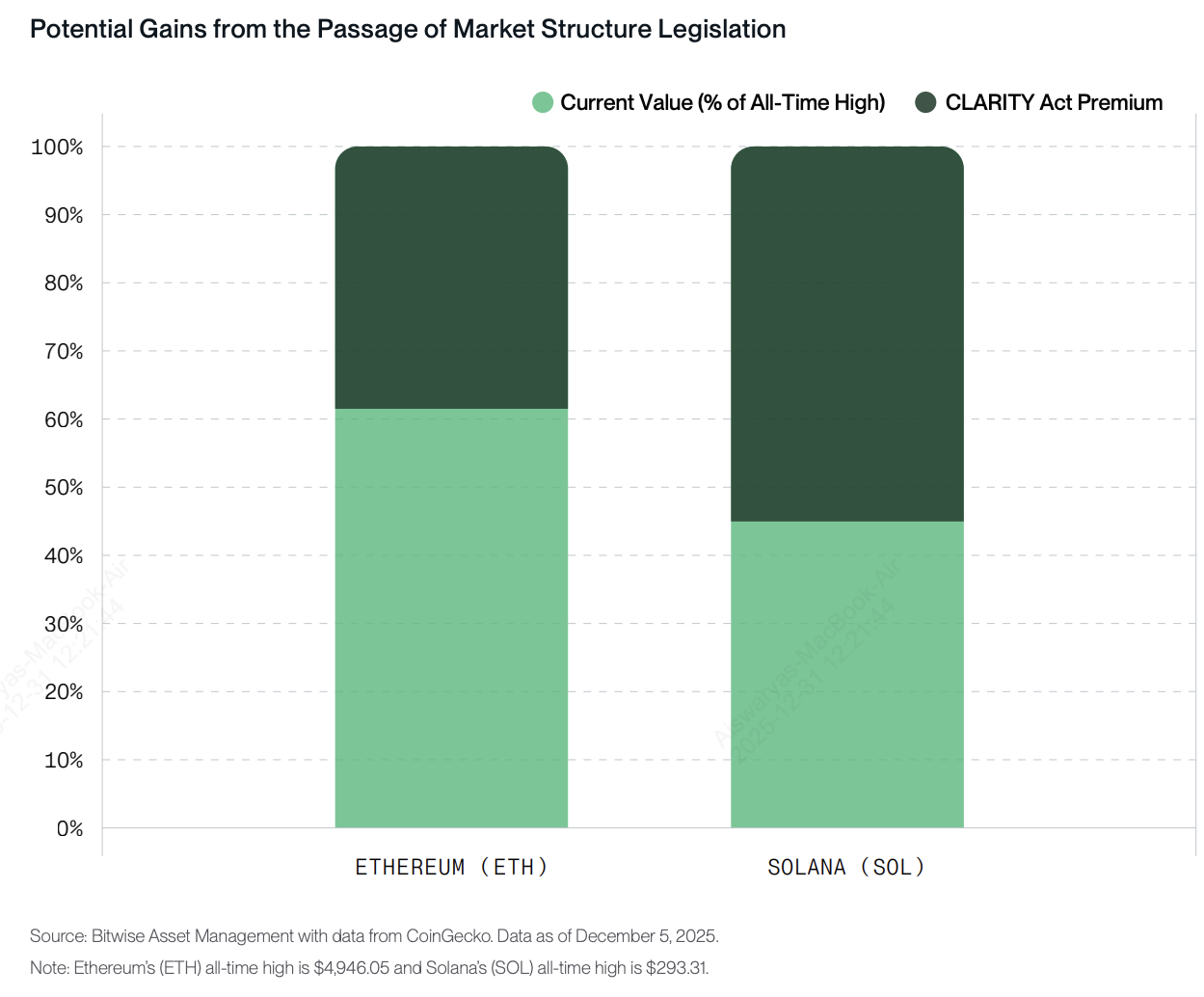

Potential Challenges for Solana in 2026

Despite strong momentum, several structural and macro-level risks could shape Solana’s trajectory in the coming year:

Solana stands to gain from US CLARITY Act | Source: Bitwise

1. Regulatory uncertainty remains a structural overhang. U.S. policymakers are still debating market-structure legislation such as the proposed CLARITY Act, which would define whether crypto assets fall under SEC or CFTC oversight. According to Galaxy Research, delays or unfavorable outcomes could slow institutional deployment, particularly for tokenized securities and stablecoins, sectors that already represent hundreds of billions of dollars in onchain value. Regulatory ambiguity could also increase compliance costs for issuers building on Solana.

2. Sustaining performance at scale remains a technical challenge. Solana routinely processes billions of transactions per month, with daily volumes often exceeding 3–4 billion transactions. While upgrades like Firedancer are designed to support far higher throughput, periods of extreme demand, such as NFT mints or viral trading events, continue to test network resilience. Any prolonged congestion or downtime could impact confidence among institutions relying on consistent execution.

Fees and TVL by blockchain in 2024 and 2025 | Source: DefiLlama

3. Competition across Layer 1s and Layer 2s is intensifying. Ethereum rollups, high-throughput L1s, and app-specific chains are all competing for the same categories: payments, tokenized assets, and onchain finance. According to industry data, Ethereum accounts for over $67 billion in TVL while

Ethereum layer-2 networks contribute over $43 billion in TVL, narrowing Solana’s performance advantage and increasing pressure to differentiate on reliability and ecosystem depth rather than speed alone.

4. Usage concentration remains a structural risk. Despite rapid growth, a significant share of Solana’s economic activity still originates from a limited number of applications, including DEXs, prediction markets, and stablecoin transfers. This concentration means shifts in user behavior, regulatory actions, or protocol-level changes could materially affect network demand.

5. Monetary policy remains a key headwind. As of late 2025, U.S. interest rates remain near multi-decade highs at 3.5–3.75%, with the Federal Reserve signaling only one potential rate cut in 2026, according to its latest dot plot. Markets currently price just a 20–45% probability of a rate cut by mid-2026, limiting risk-on capital flows into crypto. Historically, periods of restrictive monetary policy have reduced speculative and institutional inflows into digital assets, including Solana.

6. Liquidity conditions still constrain upside. Despite growing onchain activity, crypto markets continue to lag traditional assets. Since November, Solana is mostly unchanged, gold is up 9%, the S&P 500 is up 1%, while Bitcoin remains down 20%, highlighting the sensitivity of digital assets to macro liquidity. Analysts note that sustained inflows typically resume only after clear signals of easing monetary policy.

7. Capital rotation risk remains elevated. Onchain data shows that while retail participation has increased, large holders or whales have been more selective. According to market analytics, accumulation by large wallets slowed through late 2025, reflecting a wait-and-see approach tied to macro conditions rather than network fundamentals alone.

Together, these factors underscore that while Solana’s growth trajectory is compelling, its path forward depends on execution, policy clarity, and the network’s ability to scale reliably under real-world economic pressure.

Final Thoughts: Is 2026 Solana’s Breakout Year?

By the end of 2025, Solana had clearly moved beyond the experimentation phase into large-scale economic relevance. The network was processing billions of transactions per month, supporting more than $8 billion in DeFi TVL, and facilitating growing volumes of stablecoin settlement, tokenized assets, and consumer-facing applications. Institutional participation accelerated, with asset managers, payment firms, and onchain funds increasingly using Solana for real financial activity rather than speculative experimentation.

Looking ahead, the trajectory into 2026 is shaped less by technical capability and more by macro and regulatory dynamics. While institutional demand for crypto exposure continues to build, supported by ETF inflows, tokenized asset growth, and expanding onchain liquidity, factors such as interest rate policy, regulatory clarity around stablecoins, and broader risk appetite will influence the pace of adoption. If monetary conditions ease and regulatory frameworks mature as expected, Solana is positioned to benefit disproportionately, given its scale, cost efficiency, and growing institutional footprint. In that scenario, 2026 may mark not just another growth phase, but Solana’s transition into a foundational layer for global digital finance.

Related Reading