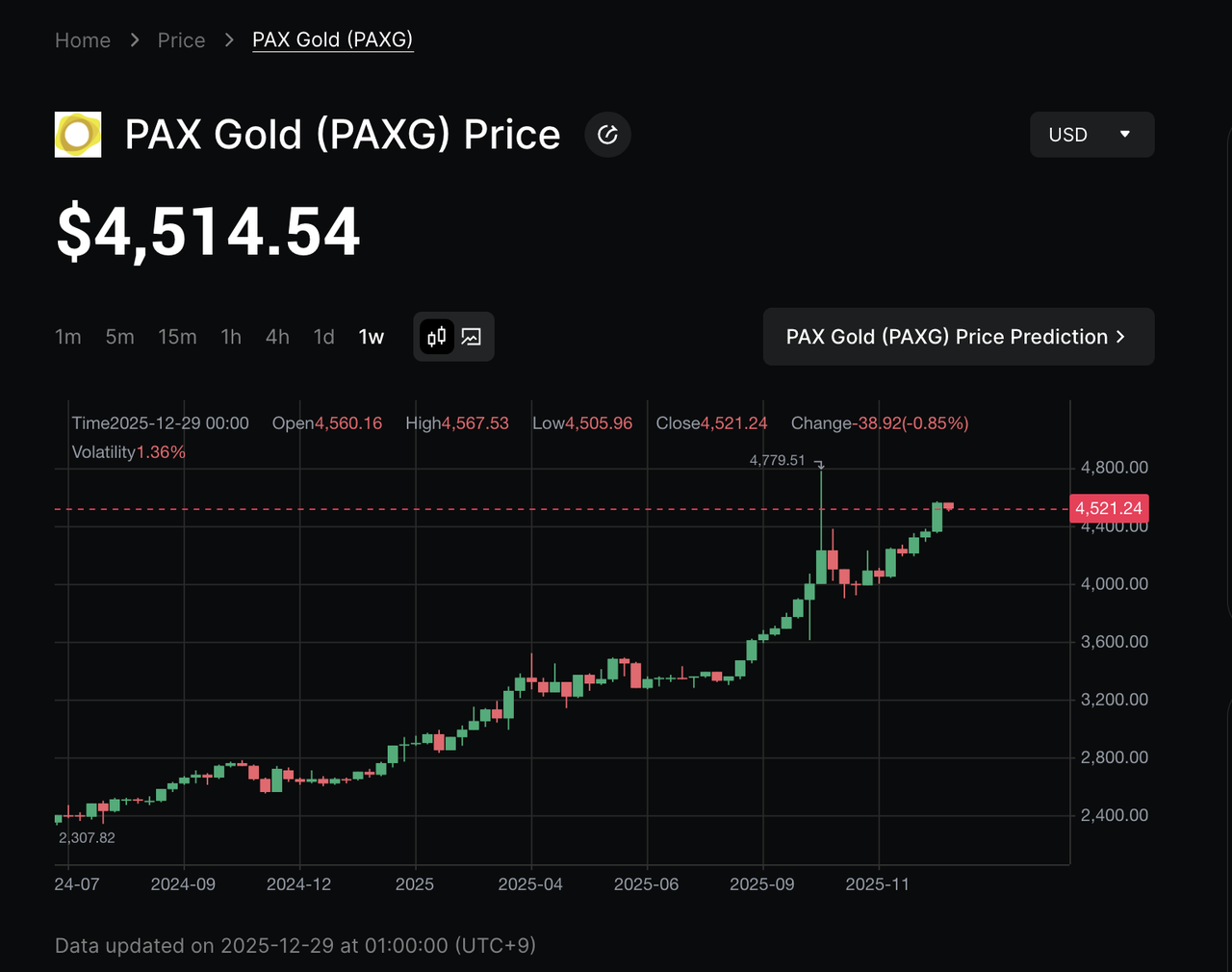

In an era where digital assets are reshaping traditional finance, gold has reasserted its role as a core store of value. By December 2025, spot gold had surged beyond $4,500 per ounce, pushing the estimated market value of above-ground gold to over $30 trillion, driven by geopolitical uncertainty, sustained central-bank buying, and expectations of easier global monetary policy.

PAX Gold (PAXG) is a regulated, gold-backed cryptocurrency that represents direct ownership of physical gold stored in professional vaults, allowing investors to hold and transfer gold on the blockchain.

Rising gold prices have also accelerated demand for tokenized gold. The total market capitalization of gold-backed crypto assets has grown to approximately $4.5 billion, as investors look for a way to gain gold exposure with 24/7 liquidity, on-chain settlement, and global accessibility. In this guide, we explain how PAX Gold works, how it is backed by physical gold, and why PAXG has become one of the most widely used gold-backed cryptocurrencies.

What Is PAXG the Tokenized Gold Coin?

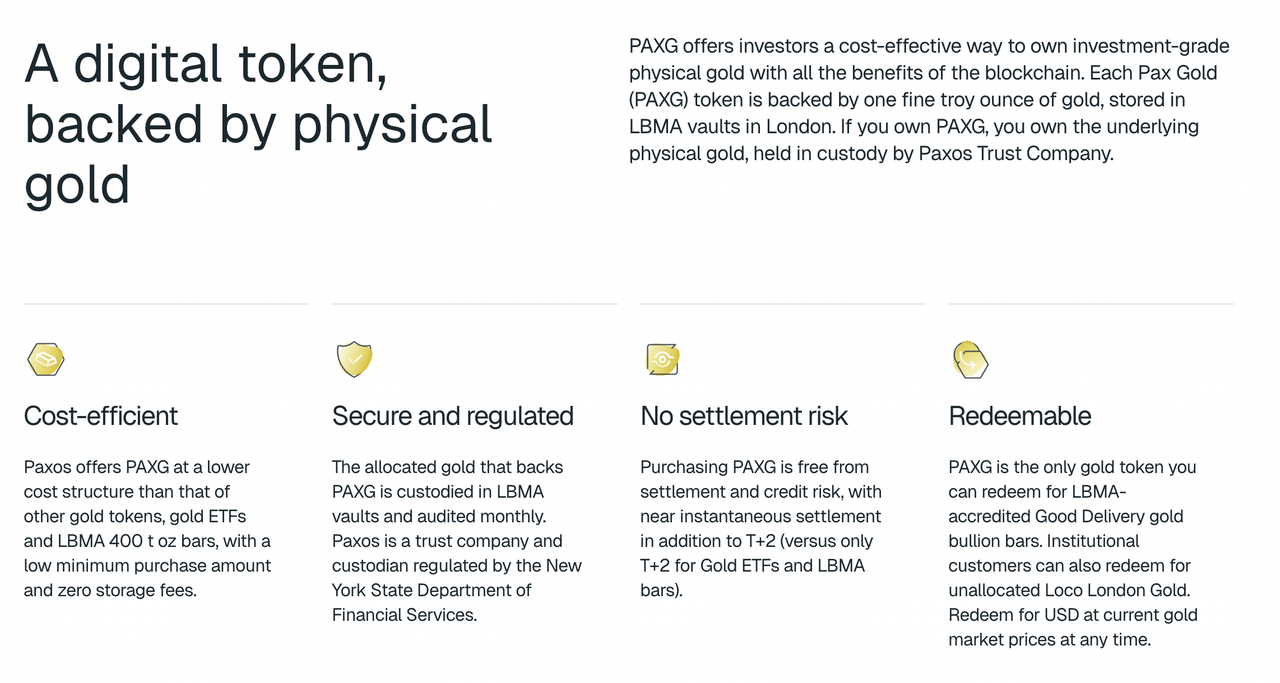

PAX Gold (PAXG) is a tokenized gold cryptocurrency issued by Paxos, a New York–based financial institution regulated by the New York State Department of Financial Services (NYDFS). Launched in September 2019, PAXG is issued as an

ERC-20 token on the

Ethereum blockchain and represents direct ownership of physical gold. Each PAXG token is backed 1:1 by one fine troy ounce of London Good Delivery gold, stored in secure, professional vaults. This structure allows investors to hold, transfer, and trade gold digitally while maintaining a direct link to real-world bullion.

Unlike traditional gold ETFs or paper gold products, PAXG gives holders allocated ownership of specific gold bars rather than indirect exposure through derivatives. Each token corresponds to identifiable gold reserves, with bar serial numbers and custody details verified through regular attestations. This model is designed to combine gold’s long-standing role as a store of value with the transparency and trust of a regulated, asset-backed framework.

As an Ethereum-based tokenized gold coin, PAXG supports 24/7 trading, fractional ownership, and fast on-chain settlement. Investors can move PAXG between Ethereum-compatible wallets, use it as collateral in DeFi applications, or redeem tokens for physical gold through approved processes. By issuing gold on a public blockchain, PAXG lowers the barriers to gold ownership while preserving the underlying value of physical bullion.

How Does PAXG Work? An Overview of PAXG Tokenomics

PAX Gold (PAXG) operates through a minting and redemption system designed to closely mirror physical gold ownership on-chain. Issued and managed by Paxos, PAXG is an ERC-20 token on the Ethereum blockchain, with each token representing one fine troy ounce of London Good Delivery gold, backed 1:1 at all times.

The issuance and verification process works as follows:

1. Gold deposit: Paxos places LBMA-certified gold bars as allocated bullion in regulated, LBMA-approved vaults operated by custodians such as Brink's.

2. Token creation: Once the gold is verified and allocated, an equivalent amount of PAXG is minted on-chain through smart contracts on Ethereum, maintaining a strict 1:1 ratio between tokens and physical gold.

3. On-chain proof: The total token supply and corresponding gold reserves are published and independently audited, allowing public verification that every PAXG token is fully backed by physical gold.

PAXG has no fixed supply cap. The total supply expands or contracts based on minting and redemption activity, ensuring full backing at all times. The token is fractionally divisible, allowing ownership starting from 0.01 PAXG, which significantly lowers the entry barrier compared with traditional gold bars. Paxos subsidizes storage and on-chain transfer costs, while fees mainly apply to direct creation or redemption and standard exchange trading.

To reinforce trust, reserves are verified through monthly independent audits, including reports from KPMG LLP, and non-custodial holders can use the Gold Allocation Lookup tool to view the bar serial numbers backing their Ethereum wallet holdings.

Together, this structure ensures that every PAXG token remains fully backed, auditable, and redeemable, positioning PAXG as one of the most transparent and institutionally robust

commodity-backed stablecoins available today.

PAX Gold (PAXG) vs. Tether Gold (XAUT): What Are the Differences?

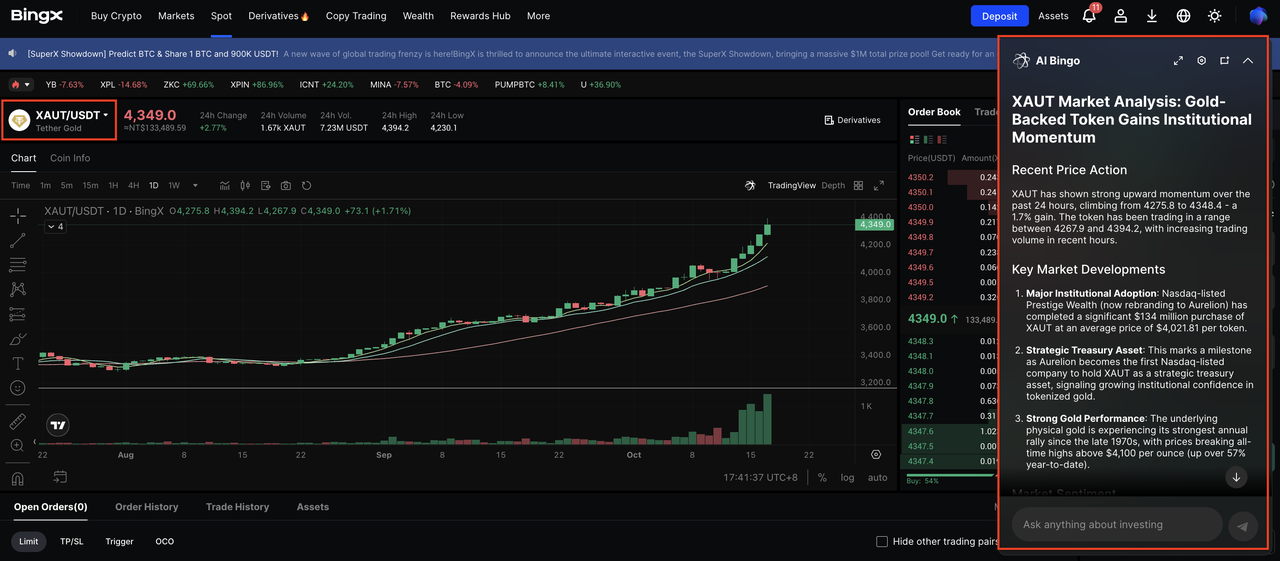

Both PAX Gold (PAXG) and Tether Gold (XAUT) are gold-backed cryptocurrencies that provide on-chain exposure to physical gold. While they share the same core concept, they differ meaningfully in regulatory structure, transparency standards, and market positioning.

PAXG is issued by Paxos Trust Company, a New York–chartered trust regulated by the NYDFS. Each token represents one fine troy ounce of allocated London Good Delivery gold, supported by monthly independent audits and a Gold Allocation Lookup tool that allows non-custodial users to verify bar serial numbers. This regulatory-first design has made PAXG especially attractive to institutions and compliance-focused investors.

XAUT, issued by Tether, is also backed 1:1 by physical gold stored in professional vaults and closely tracks spot gold prices. XAUT operates under a lighter regulatory framework and relies primarily on issuer disclosures rather than frequent third-party audits. It tends to appeal to crypto-native users already active within the Tether ecosystem.

| Feature |

PAXG |

XAUT |

| Issuer |

Paxos (NYDFS-regulated) |

Tether |

| Regulation |

U.S. trust company oversight |

Offshore structure |

| Gold backing |

Allocated LBMA gold |

Allocated gold |

| Audits |

Monthly independent audits |

Periodic attestations |

| Transparency tools |

Gold Allocation Lookup |

Limited public tools |

| Market capitalization |

≈ $1.2 billion |

≈ $2.3 billion |

| Primary use case |

Institutional-grade tokenized gold |

Crypto-native gold exposure |

In summary, PAXG emphasizes regulation, auditability, and investor protections, while XAUT leads in market size and ecosystem reach. The better choice depends on whether an investor prioritizes regulatory assurance and transparency, or liquidity and integration within the broader Tether-based crypto market.

How to Buy and Trade PAXG on BingX?

For those ready to add the stability of gold to their digital portfolio, BingX stands out as an ideal platform to purchase PAXG. BingX offers low trading fees, deep liquidity with robust market depth that minimizes

slippage and trading risks, and flexible buying options.

Whether you're investing for long-term stability or trading short-term movements in gold prices, BingX supports leading gold-backed cryptocurrencies like PAX Gold (PAXG), through both Spot and Futures Markets.

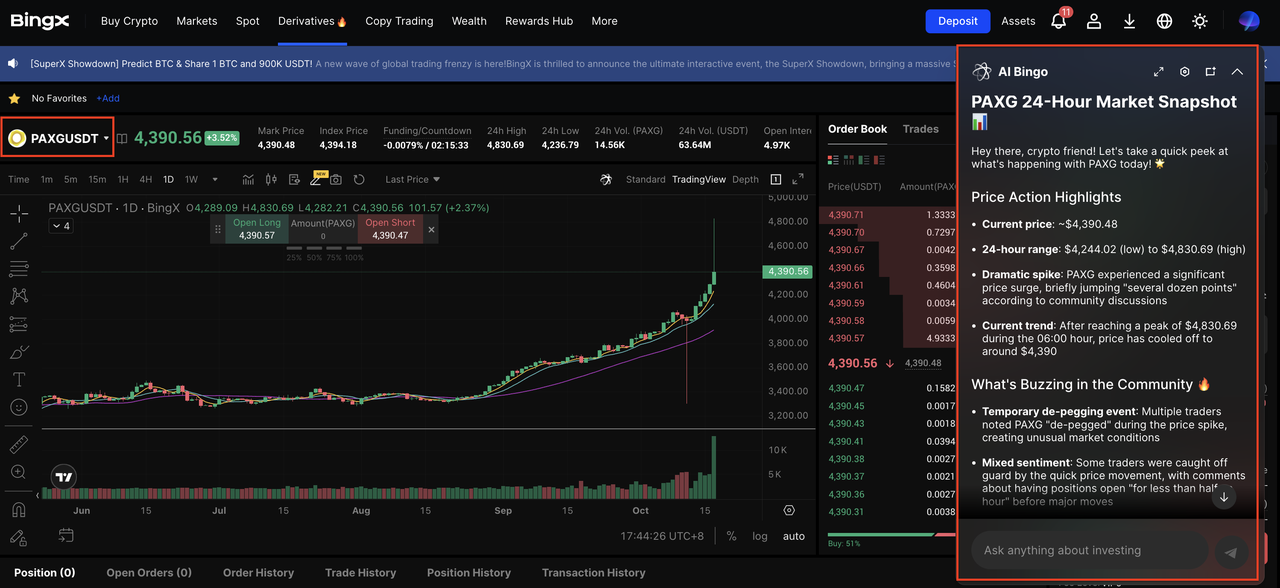

With

BingX AI integrated directly into the trading interface, you can access real-time insights, price analysis, and gold market forecasts to make more informed trading decisions.

1. Buy or Sell Gold-Backed Tokens on the Spot Market

If your goal is to accumulate gold-backed assets or take advantage of price dips, the

Spot Market is the most straightforward option.

Step 1: Go to the BingX Spot Market and search for your preferred trading pair, for example

PAXG/USDT.

Step 2: Click the AI icon on the chart to activate BingX AI, which displays support and resistance levels, detects potential breakout zones, and suggests entry points based on current price action.

Step 3: Choose between a Market Order for instant execution or a Limit Order at your preferred price. Once your trade is completed, your tokens will appear in your BingX balance, ready to hold or transfer to an external wallet.

2. Trade Gold-Backed Tokens with Leverage on Futures

For more active traders, the BingX

Futures Market allows you to trade gold-backed tokens with leverage, enabling profit opportunities in both rising and falling gold markets.

Step 1: Search for

PAXG/USDT in the BingX Futures Market.

Step 2: Click the AI icon on the chart to activate BingX AI, which analyzes price trends, volatility, and momentum in real time to assist with trade timing.

Step 3: Adjust your leverage level, set your entry price, and choose between a Long (Buy) or Short (Sell) position depending on your market outlook. Manage your position using

Stop-Loss and Take-Profit levels for better risk control.

Is PAXG Safe?

PAX Gold (PAXG) is generally considered one of the safer gold-backed cryptocurrencies, thanks to its regulated issuer, allocated gold backing, and strong transparency standards.

PAXG is issued and custodied by Paxos Trust Company, a New York–chartered trust company regulated by the New York State Department of Financial Services (NYDFS). This regulatory framework requires strict compliance, segregated client assets, capital requirements, and monthly reserve attestations, setting PAXG apart from unregulated commodity tokens.

Each PAXG token is backed 1:1 by allocated physical gold stored in LBMA-approved vaults operated by Brink's. Reserves are verified through monthly independent audits, including attestations by KPMG LLP, and non-custodial holders can view bar serial numbers using Paxos’ Gold Allocation Lookup tool.

However, PAXG still carries risks, including gold price volatility, Ethereum network risks, and custodial risk when held on centralized exchanges. Overall, its regulatory oversight and fully backed design make PAXG one of the most reliable options for tokenized gold exposure today.