In early 2026, precious metals are no longer “slow money.” They’ve become fast-moving macro trades as investors react to sticky inflation risk, currency stress, and geopolitics.

Gold hit fresh record territory near $5,300/oz in January 2026, levels that reprice the entire “hard-asset” playbook.

Silver’s upside has been even more explosive: some market trackers show an all-time high above $117/oz in January 2026, highlighting how violently silver can move once it enters price discovery.

That’s why metal-backed tokens and tokenized ETFs are gaining traction. They let you get precious-metals exposure using crypto rails, without physical storage, delivery, or traditional brokerage workflows. On BingX, you can access gold exposure through tokens like

Tether Gold (XAUT) and

Pax Gold (PAXG), and silver exposure through vehicles like

Ondo’s tokenized iShares Silver Trust (SLVON) on both spot and futures markets.

What Are Tokenized Gold and Silver Tokens, and How Do They Work?

Tokenized gold and silver tokens are digital assets that give you price exposure to precious metals using blockchain technology, without requiring you to buy, store, or insure physical bullion. Each token is structured to track the value of gold or silver through physical backing or regulated financial products, while trading like a crypto asset on exchanges such as BingX.

Tokenized gold cryptocurrencies like

Tether Gold (XAUT) and Pax Gold (PAXG) are designed to reflect the price of physical gold.

XAUT is positioned so that 1 token corresponds to 1 troy ounce of gold stored in professional vaults, with reserve attestations published by the issuer.

PAXG follows a similar model and is issued by Paxos, a regulated entity, with each token designed to represent one fine troy ounce of allocated gold. For traders, this means you can buy or sell gold exposure 24/7, in fractional amounts, using

USDT, without handling bullion, paying storage fees, or relying on traditional commodity brokers.

Tokenized silver exposure is increasingly delivered through

tokenized real-world assets (RWAs) such as

SLVON, which is built to track the iShares Silver Trust (SLV). Instead of holding physical silver bars, SLVON gives you economic exposure to silver via an ETF-linked structure, but with crypto-native benefits like continuous trading, fast settlement, and

on-chain transferability. This model is especially relevant in 2026, as silver has become more volatile and event-driven, making 24/7 access and faster execution a meaningful advantage over traditional market-hours-only silver ETFs.

What Tokenized Gold and Silver Products Can You Trade on BingX?

BingX lets you access precious metals in two crypto-native formats: gold-backed crypto tokens XAUT and PAXG and a tokenized silver ETF for silver exposure, all tradable with USDT on spot and futures markets, and available 24/7.

1. Tether Gold (XAUT/USDT)

XAUT is Tether’s gold-backed token, where each token is positioned to represent one troy ounce of physical gold stored in professional vaulting infrastructure. Trading around $5,270–$5,280, XAUT has a market cap of roughly $2.7 billion and strong spot liquidity, with recent 24h volumes exceeding $450 million. It is typically favored by investors who want gold as a strategic macro hedge alongside stablecoins and other digital assets.

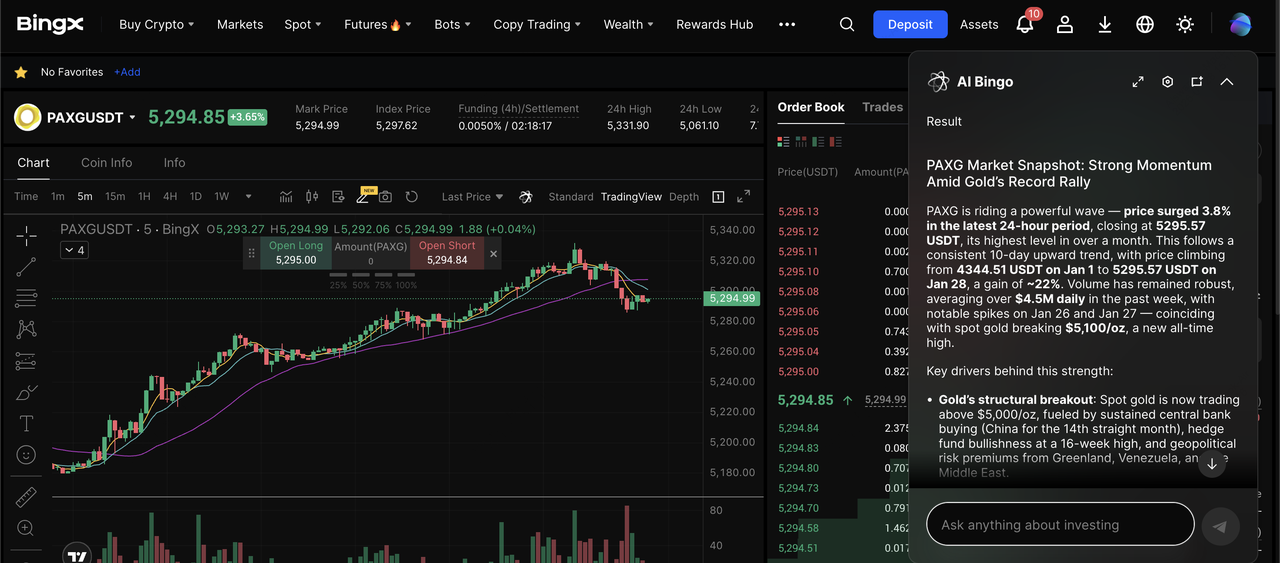

2. Pax Gold (PAXG/USDT)

PAXG is a gold-backed token designed so that 1 PAXG represents 1 fine troy ounce of physical gold, with custody and auditing handled by Paxos. As of early 2026, PAXG trades near $5,290, closely tracking spot gold after gold’s 60%+ rally in 2025. With a market capitalization above $2.2 billion and daily trading volumes in the multi-billion-dollar range, PAXG is one of the most liquid tokenized gold products available.

3. Ondo iShares Silver Trust Tokenized ETF (SLVON/USDT)

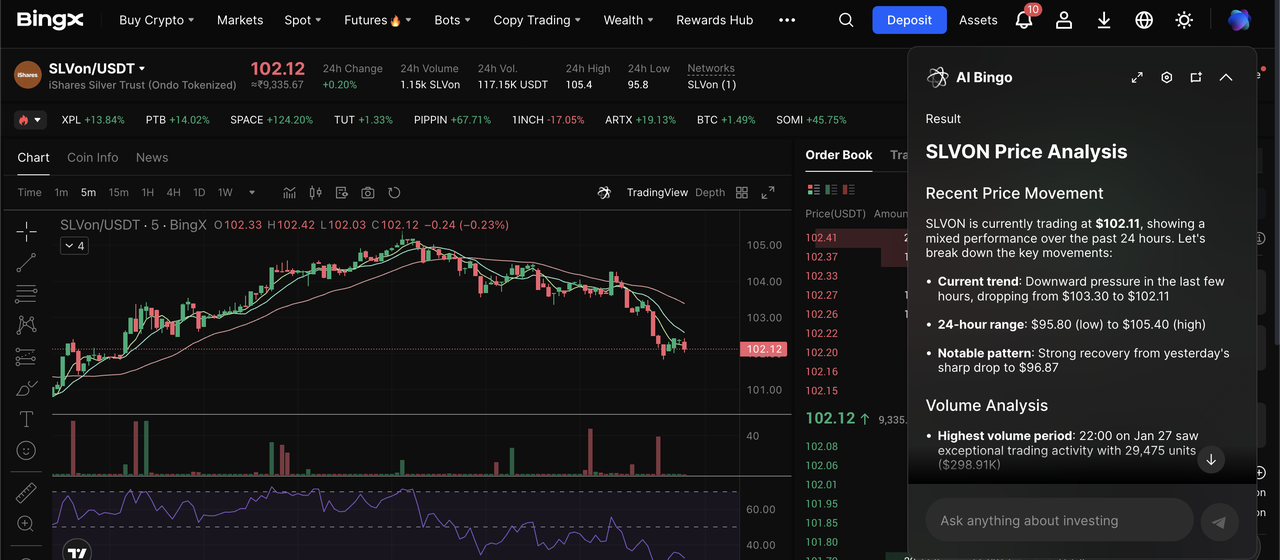

SLVON is a tokenized representation of the iShares Silver Trust (SLV), issued by Ondo Global Markets, where 1 SLVON equals 1 share of SLV, delivering economic exposure to physical silver via an ETF-linked structure. Trading around $101–$105 in early 2026, SLVON mirrors silver’s surge to record levels, following silver’s move above $117/oz in January. The underlying trust has a total market capitalization of about $58 billion, with average daily volume above $36 million, anchoring SLVON’s pricing to a deep and established silver market.

On BingX spot, SLVON allows direct, unleveraged silver exposure with 24/7 crypto market access, avoiding brokerage hours, T+2 settlement, and ETF trading constraints, making it well suited for investors who want silver exposure through a familiar ETF-style product but with crypto-native flexibility.

Why Trade Tokenized Gold and Silver in 2026: Key Benefits

In 2026, gold and silver have become high-conviction macro assets rather than passive hedges. Gold gained over 60% in 2025 and set a new

all-time high above $5,200 while silver printed a new all-time high above $117/oz in January 2026, driven by persistent supply deficits and record industrial demand. These moves reflect a structural repricing of hard assets amid elevated debt levels, geopolitical risk, and declining confidence in fiat currencies.

Tokenized gold and silver offer a more efficient way to access this repricing. Unlike physical bullion or traditional gold and silver ETFs, constrained by market hours, settlement delays, and storage costs, tokenized metals trade 24/7, settle near-instantly, and allow fractional positioning. This matters in 2026, when macro shocks frequently occur outside U.S. market hours and price gaps have become more common, particularly in volatile assets like silver.

From a portfolio and trading perspective, tokenized metals also provide flexibility that legacy products cannot. Investors can hold unleveraged spot exposure for diversification or use crypto-settled futures to go long or short, hedge macro risk, or trade volatility around events such as Fed decisions or inflation data. With consensus forecasts expecting gold to cross $6,000 and silver to test $200 in the coming months, the ability to adjust exposure quickly has become a key advantage in 2026’s metals market.

How to Trade Tokenized Gold and Silver on BingX

Powered by BingX AI, the platform combines real-time market data, trend signals, and risk indicators to help you trade precious metals with greater precision, whether you prefer unleveraged spot exposure or active futures strategies.

How to Buy and Sell Gold and Silver Cryptos With USDT on Spot

SLVon/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is ideal if you want direct, unleveraged exposure to metal prices without liquidation risk.

1. Log in to BingX and open the Spot trading section.

3. Choose Market for instant execution or Limit to set your price and place your order using USDT.

4. Hold your position as a hedge or rebalance alongside other crypto assets anytime.

Best suited for: Long-term exposure, diversification, and simple buy/hold strategies tied to gold and silver prices.

Long or Short Tokenized Gold and Silver with Leverage on Futures

PAXG/USDT perpetual contract on the futures market powered by BingX AI

Futures trading lets you go long or short and use leverage to express short-term views or hedge risk.

1. Open the Futures section on BingX.

3. Choose direction (Long if you expect prices to rise, Short if you expect a pullback).

4. Set margin mode and keep leverage low (2×–5×) to manage volatility.

Best for: Active traders, hedging portfolios, and trading volatility around macro events.

How to Trade Gold and Silver Futures With Crypto on BingX TradFi

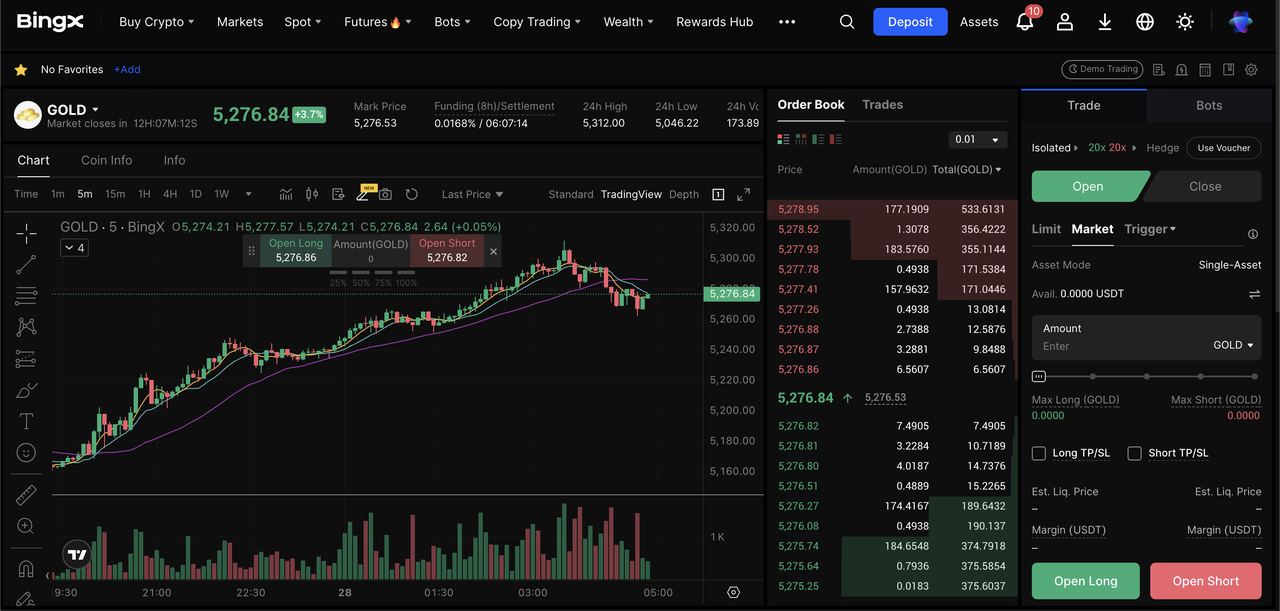

GOLD/USDT perpetual contract on the futures market

In addition to tokenized gold and silver exposure,

BingX TradFi allows you to trade gold and silver futures using crypto (USDT) as margin, while prices track traditional commodity benchmarks rather than on-chain tokens. This means you can access classic commodity futures-style exposure to long or short without opening a traditional brokerage account or using fiat rails.

In practice, you select a gold or silver futures contract in the TradFi markets' section, choose your position direction, apply risk controls, and trade metals the same way you trade crypto derivatives. This setup is popular with traders who want pure macro exposure to gold and silver prices, fast execution, and the flexibility to hedge crypto or macro risk using a single crypto-native platform.

Key Considerations Before Trading Gold and Silver Tokens

Before trading tokenized gold or silver, it’s important to understand that while these assets track real-world metals, they behave differently from both physical bullion and traditional ETFs, especially during periods of high volatility like 2026.

• Price volatility is structural, not temporary: Gold typically moves 10–20% in strong macro cycles, while silver routinely sees 30–50% drawdowns even within bull markets. If you’re trading silver-linked tokens, expect wider intraday swings and plan position sizes accordingly.

• Spot tokens vs futures risk profiles differ materially: Spot products such as PAXG, XAUT, or SLVON offer unleveraged exposure and cannot be liquidated, while futures contracts introduce leverage and liquidation risk, especially during sharp macro-driven moves around Fed decisions or geopolitical events.

• Token structure matters: Physically backed tokens like PAXG and XAUT rely on custodians and reserve attestations, while tokenized ETFs like SLVON provide economic exposure to silver via an underlying fund. Each structure carries different issuer, custody, and tracking considerations.

• Liquidity varies by product and market conditions: Gold tokens generally maintain deeper liquidity than silver products. During volatility spikes, bid–ask spreads can widen, particularly in silver-linked assets due to silver’s much smaller market size relative to gold.

• Macro sensitivity is high: Real yields, US dollar strength, and central-bank policy are the primary drivers. A 50–75 bp shift in real yields can materially change short-term metal prices, making

risk management essential around major data releases.

• Regulatory and platform risk still apply: Tokenized metals operate within evolving regulatory frameworks and depend on exchange infrastructure. Always review product disclosures, trading rules, and custody arrangements before committing capital.

Conclusion

Gold and silver entered 2026 after a historic repricing, driven by persistent macro uncertainty, supply constraints, and shifting investor behavior. Tokenized metals now offer a practical way to access this trend, combining real-world asset exposure with the flexibility of crypto-native trading. Whether used for long-term diversification through spot tokens or for active positioning via futures, gold and silver tokens have become legitimate tools for managing macro and portfolio risk.

That said, precious metals are not risk-free. Prices can remain volatile, particularly for silver, and tokenized products introduce additional considerations such as liquidity, issuer structure, leverage, and platform risk. As with any market, outcomes will depend on policy shifts, economic data, and investor positioning. Gold and silver tokens are best approached as part of a diversified strategy, with disciplined position sizing and risk management rather than short-term speculation.

Related Reading